Although adoption of crypto has historically been slower in the Nordics than in the rest of the world, more and more people — especially the younger generation — are dabbling in this new asset class.

Crypto is no stranger to controversies. At any given moment, thick headlines run across major news sites announcing the latest mega-theft or Ponzi scheme. Lacking context, uninitiated readers might consider the facts of these stories to be all the same: “Cryptocurrency is bad.”

For example, they might believe that the 2014 Mt. Gox hack was the same as the 2014-2016 OneCoin Ponzi scheme. But the Mt. Gox hack was caused by atrocious programming errors and regulatory ignorance. The OneCoin scheme, however, doesn’t even merit the term “cryptocurrency scheme” because it was a pure Ponzi swindle with absolutely no cryptocurrency in play at all.

A study published in 2021 revealed that trust is a critical factor affecting mass crypto adoption. Scary headlines do little to improve that trust.

“I tried dedicatedly for two years to break Bitcoin and failed. I was amazed at how robust it was. So I decided to leave banking and dedicate the rest of my life to blockchain technology,”

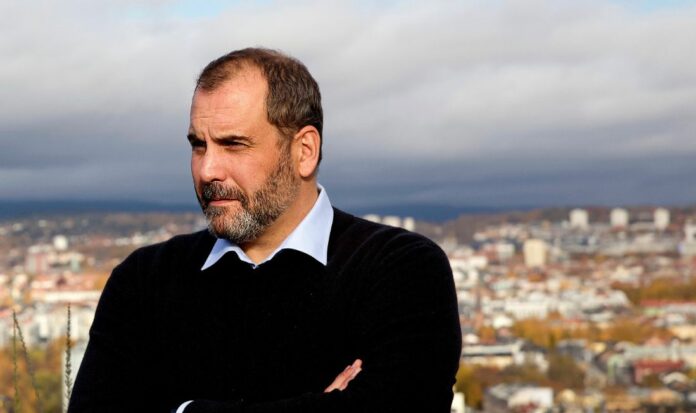

Bjørn Bjercke, Mr Bitcoin Norway

The real story of crypto

The real story of crypto is much simpler: It works. There have been glitches, but it works.

The media rarely reports that only 0.34% of all cryptocurrency transactions were illicit in 2021, according to data from Chainalysis. That amounts to about $10 billion. This is a mere drop in the ocean compared to the estimated $4 trillion being laundered through fiat currency.

Embezzling crypto is incredibly difficult. The crypto “mixer” Tornado Cash — a tool for obfuscating the source and destination of crypto funds — was the last port of call of many thieves to launder their loot. But that has now been shut down.

Another salient fact: The Bitcoin and Ethereum blockchains have themselves never been directly hacked. Underreported, these facts are yet hard to hide.

From scepticism to wholehearted adoption

The macrocosm of “scepticism to adoption” is well represented by the microcosm of Norwegian crypto consultant Bjørn Bjercke’s personal journey to becoming one of Scandinavia’s leading experts on cryptocurrency. He is known fondly as “Mr. Bitcoin” in Norway and was one of the key players involved in bringing down the $4-billion OneCoin scam, earning him a dedicated chapter in bestselling author Jamie Bartlett’s book The Missing Cryptoqueen: The Billion Dollar Cryptocurrency Con and the Woman Who Got Away with It. But Bjercke did not start out as a fan of Bitcoin. Quite the contrary.

Bjercke obtained a Computer Science degree from the University of Denver and then worked within the banking infrastructure from 1998. There he achieved a profound understanding of the SWIFT payment processing system at a detailed technical level.

“When I saw the Bitcoin whitepaper in 2008, I thought it was a scam,” he tells NFM. “I didn’t see how it was possible to transfer value using this system.”

Recommended for you:Get your copy of the Nordic Fintech Magazine Fall Edition 2022

After seeing that Bitcoin was still going strong in 2014, however, he made a decision to try and break it himself. “If no one was going to take down Bitcoin and expose its flaws, then I was going to do it. I tried dedicatedly for two years to break Bitcoin and failed. I was amazed at how robust it was. So I decided to leave banking and dedicate the rest of my life to blockchain technology.”

Why crypto adoption has been slow in the Nordics

Bjercke says that strict financial regulations in the Nordics make it difficult for crypto companies to get going.

Unlike Gibraltar and Malta, for example, none of the Scandinavian countries has a set of dedicated crypto guidelines that show crypto startups where the guardrails are, anthereby giving them more security to operate.

The financial benefit of well-defined guardrails is evident: By the end of 2021, one-third of Gibraltar’s $3.2-billion GDP was coming from cryptocurrency and blockchain companies, and some of the world’s biggest crypto heavyweights have set up headquarters there, including eToro and Crypto.com.

Crypto marches forward in the Nordics, regardless

Despite the uncertainty for companies, people in the Nordics are adopting crypto at unprecedented levels, especially the younger generation. Quoting statistics he received from the Norwegian police, Bjercke says that 98% of Norwegians between the ages of 18 and 35 have been exposed to crypto — whether by obtaining a cryptocurrency wallet, buying some crypto, or similar exposures.

Ten percent of the adult population in Norway — 420,000 people — now own some form of crypto, the majority being people under 40.

In Denmark, 11% of the population (640,000 people) either owned or used some form of crypto in 2021, up from 8% (466,000) in 2019. Sweden had the largest jump, both in percentage and quantity — 4% of the population owned or used crypto in 2019 (roughly 400,000 people), up to 9% in 2021 (almost 1 million people).

The figures might not be eye-popping, such as in Nigeria (42%), Thailand (31%), or the Philippines (28%), but they do indicate clearly that the naysayers can only go so far with their bad news. Cryptocurrency and blockchain technology march on relentlessly, their achievements speaking for themselves. And the numbers show that people in the Nordics are taking note.

Recommended for you:Get your copy of the Nordic Fintech Magazine Fall Edition 2022