Fintech in Europe

Fintech in Europe continues to dominate the headlines. Driven by innovation and a supportive regulatory environment, European fintechs are leveraging technology to relentlessly transform traditional banking and financial services.

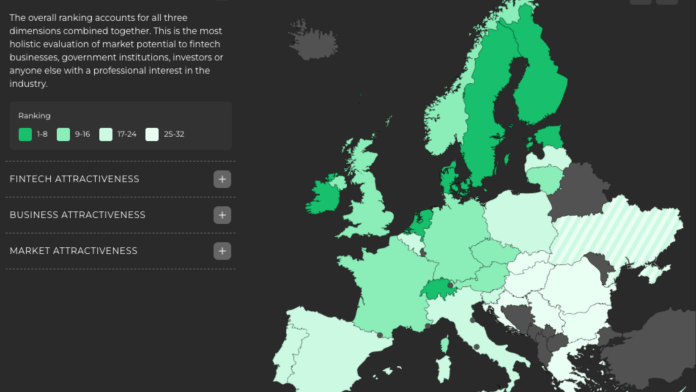

The continent is becoming a global hub for fintech startups and established players, with significant investment and a robust ecosystem. The European Fintech Index (EFI) compiled by ConnectPay provides a valuable multidimensional evaluation, using a consistent methodology to rank countries and offer insights into their respective strengths and weaknesses in the fintech landscape.

Index and Key Elements of the Methodology

The EFI is the most comprehensive index to date, encompassing essential data on business, market, and fintech dimensions. The EFI ranks countries based on three dimensions: Business Environment Attractiveness, Market Attractiveness, and Fintech Environment Attractiveness. These dimensions include metrics such as regulatory framework, market conditions, digital infrastructure, funding availability, and the number of fintech startups and licenses.

Differences in Country Development

Countries in Europe vary widely in fintech development. Leading nations have established robust regulatory frameworks, high levels of investment, and strong support systems for startups. In contrast, emerging markets are still building their ecosystems but show significant potential. Factors like economic stability, digital infrastructure, and educational resources influence each country’s fintech landscape.

The index reveals key insights about the potential of European countries to attract, nurture, and support the growth of fintech companies. It showcases how various nations are positioning themselves to foster innovative solutions that are transforming the financial market. This ongoing development highlights the dynamic and evolving landscape of fintech across Europe.

Fintechs Founded vs. Friendliness to Startups

When choosing a country for a new fintech business, a favorable regulatory framework often outweighs startup friendliness. For instance, Lithuania and Luxembourg attract many fintechs despite not being the most startup-friendly. Countries like Spain and the Netherlands show a contrast between their supportive attitudes towards startups and the relatively low number of fintechs, indicating potential for growth. Meanwhile, the UK, Denmark, Slovakia, and Slovenia excel in both attracting startups and hosting a high number of fintechs, balancing startup support with operational success.

It is important to note that the EFI did score countries on their regulatory practices since the regulatory environment informs the market maturity. European regulations and regulators are driving innovation and creating an environment for constant improvements for fintechs through unifying regulation within Europe, placing emphasis on the data-driven decisions, consumer safety, data protection and not to forget — customer satisfaction.

Continuous deployment of regulations such as MiCA, DORA, or PSD2/PSD3 are making the services in Europe not only safer for consumers but also setting a foundation for innovation and innovative businesses. Open banking, which came from PSD2, made payment services easier to use and more secure by prefilling payment information and allowing the payment to be confirmed by the payee to the bank. Account Information Services (AIS) has greatly improved and sped up credit risk assessment, which means capital in the EU has become more accessible. PSD3, with the promise of Open Finance, will make everything faster, safer, and more attractive to consumers. MiCA should make crypto service as safe and standardized as FIAT.

That said, stringent compliance requirements may also pose challenges, particularly for smaller fintech startups: they may lack the resources and manpower to iterate and adapt quickly, potentially slowing their growth. This may not be as big of an issue for more established fintechs, yet there are other challenges for the latter, including shaping their offerings to accommodate the ever-changing consumer needs. Also, maintaining compliance and managing and monitoring new trends and cyber security risks require constant and adequate funding.

Top Unicorn Hubs

Estonia leads the unicorns per capita list, followed by Slovakia, Lithuania, Hungary, and Latvia, all showcasing vibrant startup cultures.

The largest European economies, the UK, Germany, Switzerland, and France, lead in total unicorns. The UK, Estonia, and Switzerland feature in the top 10 for both per capita and total unicorns, highlighting their strong positions in the startup ecosystem.

Market attractiveness and its appeal to Fintech

The index shows a positive correlation between market and fintech rankings. Luxembourg, Sweden, and Ireland perform well in both. Slovakia, Greece, Bulgaria, and Romania lag in both areas. Smaller countries like Cyprus, Lithuania, and Estonia excel in fintech but have below-average market rankings due to their smaller markets. Conversely, Spain, Belgium, and the Czech Republic have strong market attractiveness but weaker fintech performance. This indicates varied strengths and challenges across Europe.

ConnectPay believes that providing comprehensive and up-to-date data on fintech ecosystems, through the EFI can empower fintech companies, investors, and regulators to use it as a tool to make even more informed, data-driven decisions, fostering industry growth. Furthermore, highlighting key strengths and growth areas can drive competition and innovation, particularly in emerging fintech hubs, ultimately contributing to a more dynamic and competitive European fintech market.

For direct access to the tool visit https://connectpay.com/european-fintech-index/