In May 2011 I embarked on a decade-long stint in Asia, starting my journey in Singapore. Efficiency and digitization were already deeply embedded in various services – from government to financial sectors. At that time, using cards and electronic payments for everyday transactions was a standard in high-income countries such as Singapore, Hong Kong, South Korea, and Japan.

By Ani Filipova

However, as I travelled across Asia, it quickly became evident that outside these advanced economies, cash remained king. In countries like Indonesia, Vietnam, and the Philippines, cards had limited penetration and were primarily accepted in large malls or high-end hotels. The majority of everyday transactions were still conducted using cash.

Fast forward to today, and the transformation is astounding. Asia has made a giant leap into the future of payments, fueled by instant payment systems, mobile wallets, and an exploding e-commerce market. According to data from the Asian Development Bank (ADB) , Asia and the Pacific holds the largest share of the world’s business-to-consumer (B2C) and retail e-commerce market and is expected to account for 61% of the global total by 2025. Countries such as China, India, and Indonesia have become key players in driving this growth. Indeed, the phrase “The Future is Asia” rings truer than ever.

What Drove This Transformation?

1. The Rise of Asia’s Middle Class

The growth of the middle class has been a major driver behind Asia’s payments revolution. In 2015, Asia accounted for 45% of the global middle class, growing to 54% by 2020. By 2030, it is expected that two-thirds of the world’s middle class will reside in Asia, making it the most significant market for consumer-driven growth. This demographic shift has spurred demand for convenient, secure, and accessible payment solutions.

2. Youthful Demographics

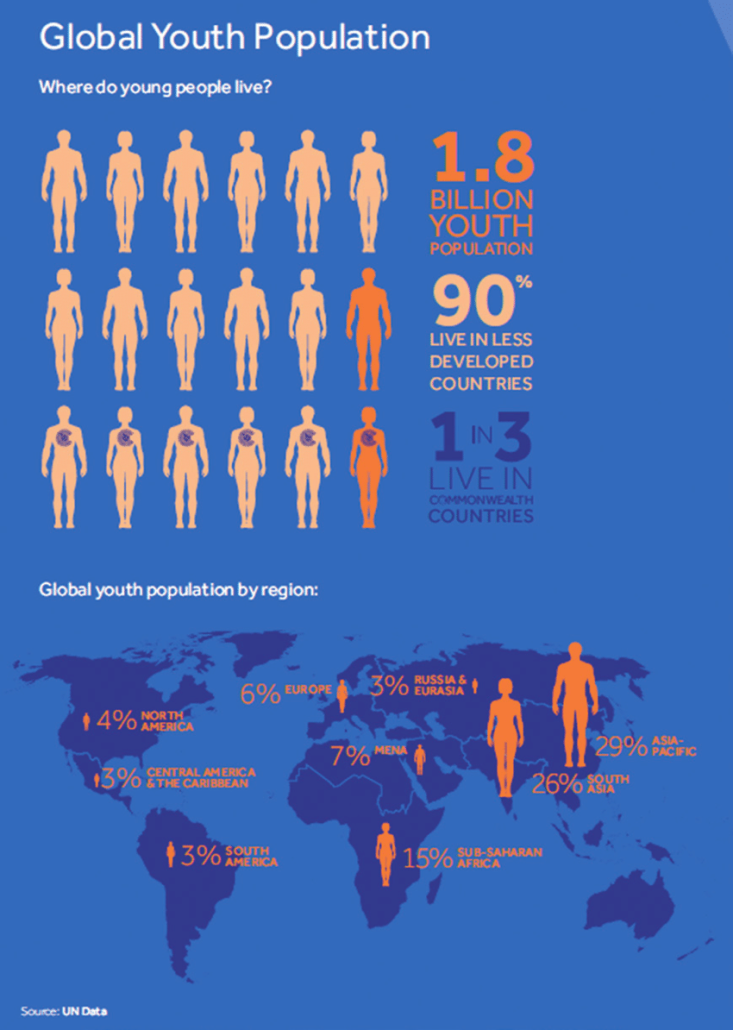

Asia is home to 60% of the world’s youth, making it the most youthful region globally. Countries like India, Indonesia, and the Philippines have a predominantly young population, which is more tech-savvy and comfortable with digital tools. This demographic prefers innovative payment methods, such as mobile wallets and peer-to-peer payment systems, over traditional banking solutions, which are often unavailable to them.

3. Technological Advancements and Financial Inclusion

The rapid development of financial technology has brought innovative solutions to previously underserved populations. Many governments across Asia have prioritized financial inclusion by implementing policies and infrastructure that support cashless payments, making it easier for people to participate in the digital economy. Initiatives like India’s Jan Dhan Yojana have helped bring millions into the banking system, enabling them to adopt digital payment methods.

4. COVID-19: An Unintentional Accelerator

The COVID-19 pandemic further accelerated the adoption of digital payments. Lockdowns and social distancing measures discouraged cash transactions, driving people to adopt contactless payments, mobile wallets, and e-commerce solutions. According to a 2023 McKinsey report, digital payment volumes in Asia surged by 25-30% annually during the pandemic years, creating a permanent shift in consumer behavior.

Key Payment Methods Driving Asia’s Revolution

1. Instant Payment Systems

Since 2016, almost every country in Asia has introduced its own instant payment system:

- India: Unified Payments Interface (UPI) processes over 10 billion transactions monthly as of 2024, with transaction values exceeding $200 billion per month.

- Thailand: PromptPay has over 73 million users, making it one of the most successful government-led payment initiatives globally.

- Singapore: PayNow have enabled seamless peer-to-peer and business-to-business payments, often completed in under 3 seconds.

- Hong Kong: The Faster Payment System (FPS) integrates traditional banking with e-wallets like Alipay and WeChat Pay, allowing QR-based and mobile number-based transactions.

These systems enable real-time fund transfers using phone numbers, email addresses, or QR codes, making them faster, more cost-effective, and accessible compared to traditional banking methods.

2. Mobile Wallets

Mobile wallets have become a dominant payment method in Asia, thanks to widespread smartphone penetration and affordable internet. In 2024, the number of mobile wallet users in Asia surpassed 2 billion, with the following key players driving adoption:

- China: Alipay and WeChat Pay dominate the Chinese digital payments landscape, collectively accounting for over 90% of the market. As of June 2024, around 969 million people in China were using mobile payments, showcasing the immense reach and influence of these platforms.

- India: The Unified Payments Interface (UPI) has revolutionized digital payments in India, with platforms like PhonePe and Google Pay leading the charge. In December 2024, PhonePe processed nearly 8 billion transactions, while Google Pay followed closely behind. Together, these platforms accounted for approximately 85% of UPI transactions.

- Southeast Asia: The region has seen significant growth in mobile wallet usage, with GrabPay, GoPay, and ShopeePay emerging as key players. These platforms are integrated into various services like ride-hailing and food delivery, making them essential for everyday transactions.

3. QR Code Payments

QR code-based payments have democratized access to cashless systems. Unlike NFC-based payments that require expensive POS devices, QR codes can be printed and scanned using basic smartphones. Countries like China, Indonesia, and Vietnam have seen massive adoption of QR code payments in small businesses and informal markets.

4. Cross-Border Payment Solutions

With the rise of global trade and travel, cross-border payments have become more efficient. ASEAN countries have implemented systems like the Regional Payment Connectivity Initiative, which allows interoperable QR payments across borders. For example, a tourist from Singapore can pay using PayNow in Thailand through PromptPay. This specific linkage between Singapore’s PayNow and Thailand’s PromptPay was launched in April 2021, marking the world’s first linkage of real-time retail payment systems.

Final Thoughts

Asia’s digital payment revolution is a testament to the region’s adaptability, innovation, and drive for financial inclusion. With a rising middle class, a youthful population, and cutting-edge technology, Asia has positioned itself as the global leader in payments. While challenges remain, the progress made over the past decade offers a blueprint for the rest of the world.